Intro

As an Expat living in the US, I’ve definitely developed an interest in exchange rates over the years (which is in no small part due to the fact that I have to exchange US dollars for Pound Sterling every month for expenses back home in England). Also, I was fortunate enough to spend one summer working on the Foreign Exchange trading desk at Barclays Capital in Singapore. So I’ve seen something of the full spectrum of how currencies are exchanged from the 10’s to the billions. It’s given me a passion for helping people to understand exchange rates better and empowering people to have a more active role in getting the best deal they can rather than simply accepting the price they see on any given day as the “Exchange Rate”.

The way we refer to exchanges rates is pretty vague for the retail customer. We are told the Exchange Rate by high street vendors before we purchase currency to take with us on vacation. Some will include an additional fee (though perhaps this is less common nowadays), others will charge a premium for trying to use your debit card, but we never really refer to these numbers as Price and really that’s all it is. If you went into the grocery store every day to buy a loaf of bread and the price was constantly changing, you’d probably question it, but more often than not, with exchange rates I see people accepting the price they pay as something that is out of their control.

The way we refer to exchange rates can get pretty confusing too. Depending on whether you are exchanging Euros for Dollars, or Dollars for Pounds etc. So for the purposes of this post, I’m just going to be talking about two currencies, but the same logic can be applied to any currency pair. The two currencies are: The Pound Sterling (or GBP) and The US Dollar (USD) and I will refer to the Exchange Rate offered between these currencies if you want to Exchange USD for GBP as GBPUSD. You should read this as: How much does one unit of GBP cost in USD. If this seems confusing, the next section should clear things up.

So what exactly is an Exchange Rate?

Skip this section if you already have a good understanding of what Exchange Rates are. I wanted to make this post accessible to everyone.

So what exactly is the Exchange Rate: GBPUSD? Well as I mentioned, it is the price of a single unit of GBP, priced in US dollars. Just like buying any other product in the United States, you pay for it in dollars and are given something in exchange for the money. The price of a loaf of bread is $3.00. You pay $3.00 and you receive 1 loaf of bread. So then, if the price of One Pound, or one unit of GBP is $1.64. I pay you $1.64 and I receive 1 Pound (or £1.00).

So in reality there is never a single “Exchange Rate”, there are lots of prices out there that people are willing to buy and sell GBP for. So who decides what these prices will be?

Well, When you are exchanging a small amount of money with a foreign exchange service, the chances are the institution you are buying from is trying to make money, nothing wrong with that. They want to sell their product to you at a higher price than what they paid for it (like most businesses).

The question then is what is the price these different institutions have to buy GBP for, so they can sell it to you and make a profit? You can think of this as being like the wholesale price that the grocery store owner will get when he buys 100 loafs of bread, of course it’s going to be cheaper because he’s buying in bulk. This is also true for exchange rates, the more you buy, the cheaper it should be.

Ultimately then, the exchange rate you will be offered by vendors will always be tied to the rate that huge banks and other financial institutions are charging each other to buy and sell. So these large institutions give us all a great benchmark for what we can expect the exchange rate to be. If we could look to see what price they were quoting each other to buy and sell in the millions, then we’d know the absolute best possible price we could find! So this is a great reference point. Well turns out we can see the price that banks are buying and selling from each other. You can find the market mid-price (the average between the price the banks will buy and the price the banks will sell GBP) on Yahoo! Finance. This is what we will be using as our bench mark in our quest to find the best deal possible when we are looking at Exchange Rates.

So what exactly should you care about when looking for the best Exchange Rate?

Nowadays it’s a lot easier to find the cheapest rate on the high street to get your vacation money. No one really charges a fee anymore, so you can get the best price just be seeing what the Exchange Rate is and find the cheapest price. What I would like to address, is the more modern challenge of looking for the best Exchange rate for non-cash transactions. What is the best Exchange Rate I can find to exchange USD directly from my US bank account, for GBP put into my U.K bank account. I would also, ideally like to be able to do this online.

NOTE: It’s important to realise that you will see different results for different currency pairs. For example, transactions with EUR and GBP will probably be cheaper and more convenient than GBP and USD, simply because US banks are a pain in the arse and all of their services costs more (in my humble opinion). So its tough to generalise from this one example, but if this currency pair isn’t exactly what you’re dealing with, this should still give you some pointers on how to go about this exercise

Before we discuss which institutions offer such a service, I want to suggest 3 things that are important when exchanging money in this way. I want the transaction to be quick (after I’ve paid, I want the money in my UK bank as quick as possible). I want the transaction to be convenient and I want it to be good value. So we care about:

- Speed

- Convenience

- Price

Fee VS No Fee transactions

Before we compare prices between institutions, we need to address this issue that same companies will charge you a fee for the transaction and other won’t. It’s not enough to simply choose the company with the lowest (or zero) fee, because really its all just different marketing. You can charge a $0 “Fee” but then charge a higher price i.e. quote a bigger exchange rate. Its a bit like shopping on Amazon or Ebay when you see $0 shipping costs, but then find that the price of the product just has the shipping cost baked in.

So, for the purpose of this comparison, for companies that charge a fee, I will just bake that into price. I will refer to that price, or Exchange Rate as the Adjusted Exchange Rate, or Fee Adjusted Rate.

Here’s an example. If I want to buy 500 GBP and the Exchange Rate is 1.64, and the fee is $10. Then the Adjusted Exchange Rate will be

It costs us dollars + the 10 dollar fee to get 500 GBP. We can generalise this concept such that if

denotes the Adjusted Exchange Rate, then

where is the quoted exchange rate of GBPUSD,

is the broker fee and

is the quantity of GBP you want to buy.

Getting the best Exchange Rate

It’s my understanding that direct transactions from bank to bank (US to UK) will probably come last in any of these metrics compared to some other institutions. Speed I’m not sure on. For convenience, I don’t believe any US banks offer any online services for Exchanging currencies, if someone knows otherwise, I’d love to use them for this comparison. So I will only be comparing institutions that offer online services. Not only is this more convenient, it makes comparing prices much easier. Finally, for Price, it’s also my understanding that bank to bank transfers are the worst possible deal. Fees are very much still present in the US for bank to bank transactions, even when just dealing with US dollars! (In the UK same currency bank transfers are free between all banks).

So who offer Exchange Rates online?

I think nowadays there are probably a whole host of companies that will offer currency exchange online. I’m going to concentrate on 3 institutions that I have personally dealt with:

- Post Office HiFX online: This is a service offered by the U.K Post Office, which I discovered when I first moved to the U.S and I was buying dollars. They were pretty easy to deal with. You give them your US bank details, specify how much you’d like to buy, then simply send them a U.K bank transfer to pay for it. However going from the US to the U.K would require a transfer from a US bank which will no doubt have some charge attached to it. They give direct quotes, with “no fee”.

- TransferWise: I came across this company fairly recently after seeing this article, which talks about the co-founder of PayPal investing in them. They present themselves as a company that offer services at much lower fees than the banks charge.

- Paypal: Ok, so this option is not actually a broker transaction. What I’ve actually done is set up two PayPal accounts for myself. One attached to a US bank account and one to a U.K bank account. Then I can simply transfer money from my US account to my UK account and of course PayPal will automatically offer you some exchange rate implicitly when you do so, since the accounts are in different currencies.

- The Benchmark: I’m comparing the quotes from these 3 institutions with the traded mid-point as quoted by Yahoo! Finance. No institution will ever offer you this price, since they will not be able to make any money from the transaction but it’s useful to see how far the quotes are from this number.

Let’s compare these 3 institutions by the 3 metrics we previously mentioned that we care about:

- Speed

- Convenience

- Price

1. Speed

The PostOffice gave the following information along with a online quote:

We must be in receipt of cleared funds and onward instructions by midday on the Payment Date in order to send the payment on the same day.

You should always allow 1 to 4 working days for the payment to arrive with the recipient.

TransferWise gave an estimated date of receipt of funds 1 week after the date of the quote.

PayPal on the other hand takes a matter of minutes to complete both transaction (sending money to PayPal and withdrawing from PayPal).

The following table summarizes these estimates on timing:

| Price Source | Time of transaction |

|---|---|

| Post Office Hifxonline | 1 to 4 days |

| TransferWise | 1 Week |

| Paypal | 10 minutes |

| Yahoo finance | N/A |

As you can see PayPal is a clear winner here.

2. Convenience

Paypal has to be the winner here too. It takes me less than 5 minutes to complete the transaction. That includes the time to send the money to my U.K PayPal account and to send it from there to my U.K bank account. TransferWise and the PostOffice are more or less the same in this department, both offer online quotes and the transactions can be completed online. If we included some US bank in this comparison, I’m sure they would have trouble competing.

It is however worth reiterating that both the quotes offered by the Post Office and TransferWise are just estimates. The rate will be set at the time they process the transaction, not when you have submitted the request. TransferWise however will not process the transaction if the rate moves more than 3% against you (and they also allow you to flex this tolerance from 0%,1%,2% or 3% which is a nice feature)

3. Price

Ok probably the most important metric, though really that’s only true if the prices differ that much. I began by looking for a quote online from each institution to buy GBP 500 and compared those quotes to our benchmark. I also took note of any fees that would be charged along with the transaction.

All prices were taken at around 10pm EST on 12 Feb 2014

| Price Source | Quantity (GBP) | GBPUSD Rate | Fee (USD) | Cost in USD |

|---|---|---|---|---|

| Post Office Hifxonline | GBP 500 | 1.7121 | USD ——– | USD 856.05 |

| TransferWise | GBP 500 | 1.6701 | USD 12.61 | USD 847.66 |

| Paypal | GBP 500 | 1.6894 | USD 4.22 | USD 848.93 |

| Yahoo finance | N/A | 1.6447 | N/A | USD 822.35 |

As you can see the Post Office do not show an up front fee but their quote is also furthest from the benchmark. TransferWise have the highest upfront fee. They also offer a warning that in order to pay them from a US institution, a Swift Transfer would be required which will most likely have a fee attached to it. Here’s what they said:

USD transfers need to be made to TransferWise’s bank account in Europe. You have to ask your bank to make an international SWIFT transfer. Your local bank will most likely charge you for this transfer and it often cost between $30 and $50 – that’s expensive but you will still save lots compared to your bank thanks to TransferWise.

We are working on supporting domestic payments in the US, stay tuned!

I called up Schwab (who I bank with in the US) and they quoted me $25 for such a transfer, but this will really depend on who you bank with. For this example lets assume the bank fee is $25 per transaction for both the Post Office and for TransferWise. That’s probably the best deal you could get. These fees will be added to the fees charged by each company.

It is worth noting that if in the future TransferWise were able to accept payments without the bank fee (and it sounds as though that is their intention), they would actually be a little cheaper than PayPal. At present TransferWise seems as though they’d be a good choice for European transactions.

Both TransferWise and the PostOffice require payments to be made from the US into accounts in the UK. So perhaps this fee wouldn’t be present when dealing with a US broker, but I haven’t found one with online quotes yet.

To make this a fair comparison, let’s calculate the fee adjusted rate for each institution as described above, then plot the results:

| Price Source | Quantity (GBP) | GBPUSD Rate | Fee (USD) | Fee adjusted rate | Cost in USD |

|---|---|---|---|---|---|

| Post Office Hifxonline | GBP 500 | 1.7121 | USD 25.00 | 1.7621 | USD 881.05 |

| TransferWise | GBP 500 | 1.6701 | USD 37.61 | 1.7453 | USD 872.66 |

| Paypal | GBP 500 | 1.6894 | USD 4.22 | 1.6979 | USD 848.93 |

| Yahoo finance | N/A | 1.6447 | N/A | 1.6447 | USD 822.35 |

Paypal comes out on top, saving around $20.00, meaning that if TransferWise were able to provide their service without the bank fees they’d actually be the winner here! (They may then become a viable option for the future). Even so, it would only be a saving of $5 compared to Paypal and PayPal was a clear winner in metrics 1. and 2.. The Post Office is another $10.00 on top of TransferWise.

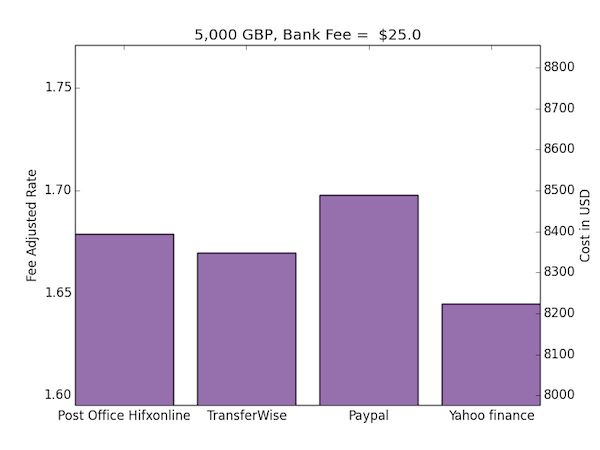

Now let’s see how the quotes change if we alter the amount of GBP we are purchasing from 500 GBP to 5,000 GBP. Remember we would expect to see a discount here, when we are “buying in bulk”:

| Price Source | Quantity (GBP) | GBPUSD Rate | Fee (USD) | Fee adjusted rate | Cost in USD |

|---|---|---|---|---|---|

| Post Office Hifxonline | GBP 5,000 | 1.6739 | USD 25.00 | 1.6879 | USD 8,394.50 |

| TransferWise | GBP 5,000 | 1.6547 | USD 74.62 | 1.6696 | USD 8,348.14 |

| Paypal | GBP 5,000 | 1.6894 | USD 42.24 | 1.6979 | USD 8,489.34 |

| Yahoo finance | N/A | 1.6447 | N/A | 1.6447 | USD 8,223.50 |

Ok, at this level PayPal no longer becomes a good deal. Both of the algorithms that set quotes for the PostOffice and TransferWise offer a better deal when you’re buying in bulk, whereas PayPal’s price is fixed regardless of quantity. At this level the bank fee becomes less significant a cost (assuming it is not dependent on quantity). Using either of the brokers would save you around $120 compared to PayPal and there’s not really much difference between them.

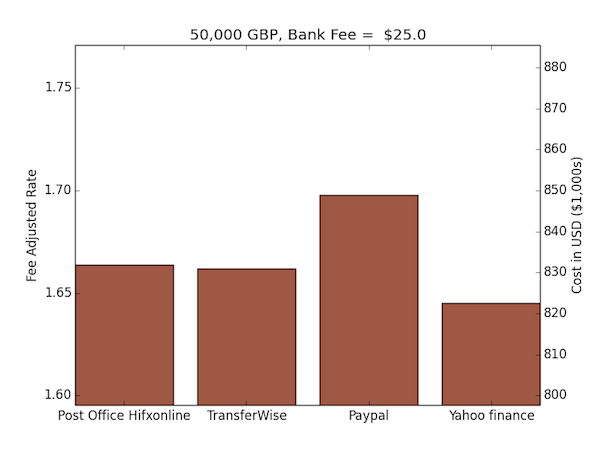

Finally, let’s see how the quotes change for a quantity of 50,000 GBP:

| Price Source | Quantity (GBP) | GBPUSD Rate | Fee (USD) | Fee adjusted rate | Cost in USD |

|---|---|---|---|---|---|

| Post Office Hifxonline | GBP 50,000 | 1.6634 | USD 25.00 | 1.6639 | USD 83,195.00 |

| TransferWise | GBP 50,000 | 1.6532 | USD 444.69 | 1.6621 | USD 83,102.85 |

| Paypal | GBP 50,000 | 1.6894 | USD 422.35 | 1.6979 | USD 84,893.35 |

| Yahoo finance | N/A | 1.6450 | N/A | 1.6450 | USD 82,250.00 |

As we increase the quantity we purchase, both broker’s quotes move closer and closer to the benchmark. It’s probably also worth noting that after such a large increase in quantity, the Fee adjusted rate is still remarkably close for the two firms. At this level you’d save around $1,800 dollars using one of the brokers compared to Paypal, which is no longer peanuts (though I’m honestly not sure you could move this much money through PayPal, I think additional fees would kick in at some point, I’ve never dabbled at this magnitude for obvious reasons).

Conclusions

Firstly I want to point out that this analysis is just a snapshot. It is a single point in time and a single observation. My next step is to find a way to automate picking up quotes from these websites so we can see if these relationships persist overtime. For now lets see what conclusions we can draw (assumptions we can make) from what we’ve found so far.

So which option should we use? Keeping in mind 1. Speed, 2. Convenience and 3. Price.

The answer is: it depends. It depends on how much you want to exchange and how frequently you want to make payments and on how quickly you need the payments to arrive.

Because the rate offered by PayPal was fixed, regardless of quantity. It was easy to find the quantity that would be needed to purchase from TransferWise, such that their Adjusted Exchange Rate matched PayPal. i.e. We can find the exact dollar amount to be used on a cap in size on PayPal Foreign Exchange transactions, there after, we should switch to TransferWise. Well, it looks to be somewhere around $1,500

- For transactions <~$1,500, PayPal is a clear winner on points 1. and 2. and for smaller transactions, they also have the best price since we are able to avoid bank fees

- For transactions >~$1,500, TransferWise come out in front. TransferWise were more or less tied with the Post Office on 1. and 2.. For 3. TransferWise had the best price for transactions greater than ~$1,000.

- For transactions > $50,000 the Post Office may perhaps become a better deal, but it does look as though the prices from the two brokers were converging together.

So which of these services do I use personally?

- Well transactions >~$1,500 aren’t something I need to deal with at the moment so I don’t use any. But if I did then I’d probably use TransferWise (OR possibly a fourth option which I’m yet to mention).

- For transactions <~$1,500 I do use PayPal, but only some of the time. I find they are incredibly useful for making payments when I need to be quick and it’s still the best Adjusted Exchange Rate I can find. But there is a fourth option we haven’t mentioned yet and that is as follows:

The Fourth Option (The better way?)

This option is simple but harder to find. Look for someone with needs that compliment your own.

In my case someone that has GBP and wants to buy USD. If you have mutual needs, then you can both simply trade at the market mid point. The price quoted by Yahoo! Finance. In this capacity both myself and the person I exchange with are able to save money. It’s also pretty damn 1. Speedy, (I PayPal him the funds in the US, no cost there and super quick) and he transfers GBP into my U.K bank account (no cost there either and super quick). In terms of 2. Convenience, well, its convenient most of the time, but when I have an ad-hoc need, I go to PayPal.

I honestly believe there are greater opportunities for people to find one another with complimentary needs, now that we are all so globally connected and I still like the idea of some kind forum based space where people could make exchanges at the market mid point. Of course there’s lots of challenges that arise with this model. You need to have complete trust or guaranty with the person you are exchanging with. None the less I think its conceivable. I recently posted to the forum of Internations, an entity that helps expats connect with one another. I posed the question to the expat community “How do you make sure you’re getting the best exchange rates?” Most people’s responses were simple. They didn’t. They accepted the price quoted to them by their banks as “The Exchange Rate”. They weren’t aware of whether they were getting a good or bad deal. Here’s an example response that I received:

It is a very difficult situation, isn’t it? I’m from the UK and now living in the US, and my husband and I used money from my English account to pay for visa costs when I first arrived, which meant transferring my English money to our US account. We just did a swift transfer via bank and I didn’t like to think about how much money was lost in the transaction. If there is a better way, I’d be eager to hear about it!

I think there is a better way. I just haven’t quite figured out what that is yet.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and

now each time a comment is added I get three e-mails with the same comment.

Is there any way you can remove people from that service?

Appreciate it!

Hey there, err.. I’m not sure. I think you probably want to send this question to the wordpress guys rather than to me. I’m sure they will be able to take care of it 😉